Today, Occupy Wall Street called on borrowers to stop repaying their student loans. The All Things Considered story that I heard this evening seemed so timely, as we just spent the entire weekend once again going over our budget with a fine-tooth comb, most specifically to discuss what to do about our student loans.

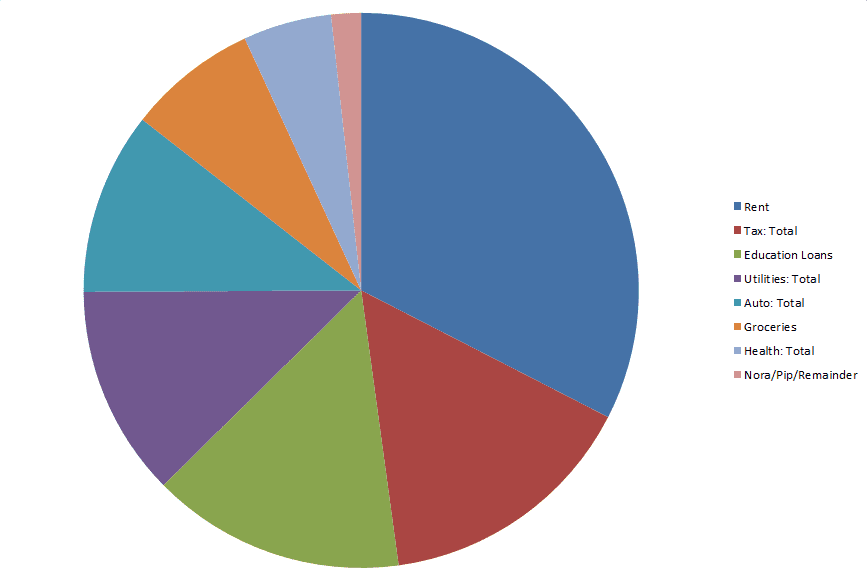

I’ve mentioned before that, though we’ve never carried a credit card balance, we are currently buried in a lot of student loan debt. Between our three degrees, we have loans which, even at minimum payments, total 15% of our monthly budget — the only things we spend more money on are rent and taxes. It’s a lot of money to watch leave our bank account.

With the exception of seven months after Nora’s birth, we have never had two incomes (first I worked while Chris did culinary school, now he’s working while I stay home with Nora). Only having one income means the amount we pay each month toward our student loans is a pretty big deal.

We are working our hardest to get rid of the loans as fast as possible and have already paid off just shy of $20,000. (Hooray!) Like anyone, we have our moments of weakness, but we try very, very hard to budget and save every penny to make extra principle payments as often as possible. In the last few weeks, however, I have gotten especially frustrated with the slow pace. Now that I don’t have reliable income coming in, we’re back to only paying for the basics:There’s no fun money, no eating out (for real, I don’t even have money to tip a waiter at The Brotherhood anymore), but most annoyingly, there’s no extra money to put toward debt. If the websites stay steady, then those things become possible, but if not I may have to start babysitting again. …Or we have to figure something else out.

For about 20 minutes last week, I almost applied for a job. One of the local non-profits was hiring an office manager and the advertised salary was not too much less than what I made in New York. I knew I could have done the job and, being the person that I am, I probably could have enjoyed it. I almost talked myself into thinking how much Nora might like playing at daycare a couple of afternoons per week. But then, I though about that time I would be losing with her, and I thought, most especially, about the time I would be losing with Chris.

When I was working in New York, Chris and I were like ships passing in the night. We were on completely opposite schedules; we rarely shared a day off or even an evening together. It was so incredibly hard. Since I quit my job, we’re all able to live on restaurant time (not just Chris), which means we get to see so much more of each other. Nora spends her days with either Chris or me or both of us, and is thriving. If I were to go back to work, we would lose that. We would lose each other. We would lose a good deal of our relaxation. We would be even further away from cleanliness and a put-together house than we are now.

One of the things I hear over and over is how hard it is to make having one parent at home work. People constantly say that in this economy and this day-in-age it’s “impossible” to have a family on only one income, or that people who can do so are privileged or wealthy or lucky.

Certainly, there are many income levels below us that would make living on one income impossible, or much less desirable as far as quality of life. But I don’t believe it’s as hard to do as people say it is. We are not wealthy or extraordinarily lucky, we just decided that this is a priority and so we make it work. I think if you’re willing to make sacrifices, if you’re willing to value experiences and time with your child over material things, then most families can afford to have a parent at home.

It is so easy to fall into the money trap. To start thinking, boy if I just had $20,000, or $30,000 or XXX more, I could do… I know, that’s what I did last week. I looked at that job and for a moment, all I thought about was the money. Just one year, I thought, One year of us living like we’re living but with extra income and I could almost pay everything off. On the surface, it seems like a no-brainer, but the more I thought about it, the more I realized I wasn’t willing to sacrifice my family and my limited time with Nora, and Chris was in agreement.

I knew I wasn’t going to suddenly add a significant amount of income, but seeing that job still rekindled the get-out-of-debt fires, and so this past weekend, all I did was number crunch. There’s not much more we can shave off our budget. We were lucky to find our current house which is below the market rent because it’s technically a one bedroom; we aren’t exactly chomping at the bit to live somewhere smaller. We’ve already cut most discretionary spending. Then suddenly it occurred to me that there is one area where we can make a big financial change:

The car. I realized that if we sold our car, we would have about $500 extra to put towards loans each month, and an immediate payment of several thousand because the car is worth more than what we owe on it. So I floated the idea by Chris: what if we get rid of our car?

He thought I was nuts. How can we live without a car? What about winter? What if we want to move someday? And most importantly, we can afford it, so why wouldn’t we have it? But we talked and talked and talked, and eventually the idea didn’t sound crazy anymore. We live less than a mile from everything. We’re already used to walking in every kind of weather. We have bicycles and a trailer for Nora or cargo. We’re already into simple living. So we’re thinking about it, and we’re doing a little experiment:

Starting yesterday and for the next month until we leave the island for Christmas, we won’t be using the car at all (with the one exception of going to the landfill). If this month-long no-car experiment goes well, then we’ll get serious about trying to sell it in the New Year.

I’m looking forward to the challenge and seeing how it goes. Chris is on the fence, but agreed to try. The other two members of our family might be the most excited, since walks and stroller rides are about their favorite things right now.

Today, I’m thankful for the fact that we are making keeping me at home work. I’m thankful that Chris was willing to consider my somewhat radical no-car idea, and I’m thankful that the first two days of the experiment went well.

Readers: Would/could you get rid of your car? Am I crazy? Do you think we’ll make it through November with our breaking down and driving? I’d love to hear what you think!

Leave a Reply